An Unknown Play On An Upcoming Baby Boom

*This is not financial advice. All content should be considered opinionated. We are not responsible for any of your gains and losses. I am neither a licensed nor registered financial expert. Please see a financial advisor before making investment decisions.

Every minute, 250 babies are born. When a child is born, the blood in the umbilical cord holds a lot of stem cells. That blood can be stored and used to help the child in the future if ever they get sick in the future. Imagine if there was one company that was positioned to capitalize on that.

That company is Global Cord Blood Co. (NYSE: CO).

Parents pay Global Cord Blood Co. to store their umbilical cord blood (and that number continues to grow). Why? Because parents want their children to have access to whenever they might need it one day. Diseases can strike them at any time.

One of the great things about Global Cord Blood Co. is that it can be compared to a monopoly. In China, the nation has 7 cord blood banking licenses. Global Cord Blood Co. has 3 of them and owns around 24% of the licensed cord blood banks in Shandong province. With that, China won’t be issuing more licenses, strengthening its monopoly.

In their recent investor presentation, Global Cord Blood Co. is said to be the largest cord blood bank in China!

And their profit margins are really high! Gross margins of 81% are something you rarely see.

The science that this company is involved in is game-changing! Stem cells have been the talk for a long time. By being the business that stores a lot of stem cells in the blood, Global Cord Blood Co. is positioned to capitalize on this growing industry.

And here's an overview of the cord blood banking market

One great aspect of the cord blood banking industry is that it has a lot more growth ahead of itself!

As you can see from their milestones, Global Cord Blood Co. continues to grow its subscriber base

And it continues to have a large market share in China!

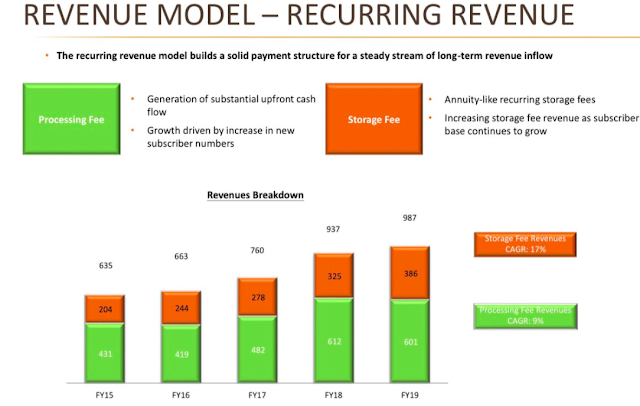

One of the best things about a Global Cord Blood Co. is that they have a recurring revenue model. This is really attractive to investors as that money just keeps coming in. If SaaS companies and other companies that run on a subscription model (like Spotify and Netflix) garner high valuations, then this company should garner high valuations as well.

For those curious about how the company convinces parents to have their cord blood stored rather than disposed of, this is how Global Cord Blood Co. is able to get parents to subscribe to the cord banking scheme.

While Global Cord Blood Co. continues to receive growth in subscribers, Chinese zodiac signs influence when that subscriber growth happens. If you want more information about it, I recommend researching about Chinese zodiac signs yourself and talk to experts about it.

Global Cord Blood Co. has had a huge track record of growth. This adds credibility to the company for growth investors.

|

|

And finally, here are the variety of diseases that stem cells can treat. When parents see this huge list, many of them are willing to have their cord blood stored for years so that their child can survive and overcome these terrible diseases.

Overall, the cord blood banking market will continue to grow as more couples have babies, and as more people learn the benefits of storing cord blood for their children. While the company has a market cap of around $370 million, I believe that there is a lot more upside to it. It looks like the company is focused on the cord blood banking market in China and because of its market position, it's well-positioned to take advantage of the upcoming baby boom in China.

And if the company can expand its presence to other countries, it can take advantage of the growing populations there. Imagine how much growth this company will experience if it allocated a lot of resources to India or Brazil or even the US.

If this company can profit off of any baby that is born on the planet, then this is a company that holds so much potential.

Comments

Post a Comment