A Contrarian Pick in the Healthcare Sector

*This is not financial advice. All content should be considered opinionated. We are not responsible for any of your gains and losses. I am neither a licensed nor registered financial expert. Please see a financial advisor before making investment decisions.

While many think of the healthcare sector as a defensive sector, some industries within the healthcare sector are more cyclical than defensive. For this blog post, we're going to be talking about a healthcare stock that is more cyclical than defensive in nature.

This company is Tivity Health (NASDAQ: TVTY), a leading provider of fitness and health improvement programs, with strong capabilities in developing and managing network solutions. For this blog post, we will analyze Tivity's investor presentation from January of this year.

Some things that stand out:

- Their customer base consists of many health insurance companies like United Healthcare, Aetna (part of CVS), Anthem, Humana, AARP, etc.

- They are a provider of "fitness and health improvement programs" that focus on longevity

- 80% of their revenue came from people 65+ which means that they are a play on the aging population

- 18,000 locations for their fitness network!

According to that slide, Walmart is one of its blue-chip customers. In January, Tivity partnered with Walmart. In the partnership, Tivity agreed to provide fitness programs to its associates and their dependents. Tivity will give 1.5 million Walmart associates and their dependents the Walton Life Fitness Pass in exchange for being deducted $9 per paycheck. This will provide a lot more clients for Tivity.

The Walmart partnership was made to help Walmart employees stay healthy. Giving them discounted passes to Tivity's fitness programs gives employees a way of getting exercise. For nutrition, Tivity and Walmart are looking at subsidizing food from Nutrisystem for employees.

While Walmart might be one of the first blue-chip clients to partner with them in providing health programs to its employees, other companies might take note of Walmart's partnership and attempt at creating a similar partnership with Tivity.

In May of 2019, Tivity completed its acquisition of Nutrisystem. Currently, there is speculation that Tivity might have to conduct a huge write-off from its acquisition of Nutrisystem. Let's dive into this theory.

Tivity acquired Nutrisystem for $1.3 billion in cash. The company had to write down more than $199.5 million worth of goodwill from all nutrition brands operating under its umbrella recently because of the coronavirus recession. When accounting for the goodwill and debt, Tivity would see a massive shareholder deficit. With gyms closing, the demand for protein shakes and foods usually consumed by gym-goers collapsed. Having little cash, the company has fewer resources to handle its shareholder deficit.

Now, let's look at the positives from the Nutrisystem acquisition.

By acquiring Nutrisystem, Tivity was able to gain more exposure to the growing weight-loss industry. The weight-loss industry is a growing industry with a lot of demand. Many Americans are either overweight or obese and the population of obese adults continues to increase.

There are a variety of reasons why this phenomenon is happening. With Tivity positioned to tackle the problem, Tivity's businesses are expected to grow as this population continues to increase.

Tivity isn't only in the business to help those that have money but also to help those with little money. SDoH, known as Social Determinants of Health, are conditions in the places where people live, learn, work, and play and how they affect a wide range of health risks and outcomes.

This slide further explains their SDoH program.

For the post-discharge meal program, the program focuses on the nutritional needs of people recovering from their stay in a hospital or a skilled nursing facility. For the wellness meal bundles program, this program focuses on providing meals appropriate for those that are under certain diets because of their condition. The chronic condition program focuses on providing the nutritional needs of those suffering from chronic conditions. Overall, they're a meal provider to various types of customers.

Now, let's look at Tivity's financials.

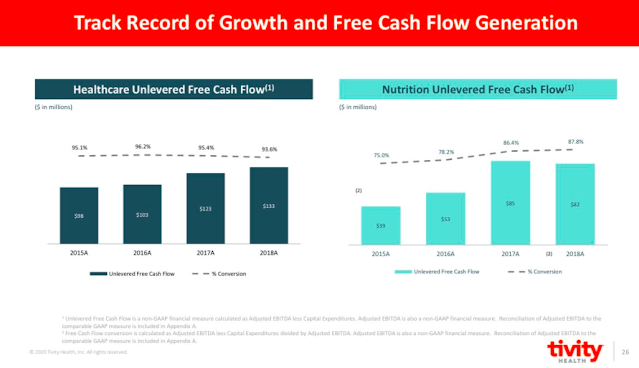

Interestingly, the company has shown positive unlevered free cash flow. Since it has a lot of debt, that free cash flow will be a lot less but according to Yahoo Finance, it's still free cash flow positive.

And here's a bigger view of Tivity's financials.

Since revenue is growing, at least it's safe to say that the company is continuing to grow. According to the adjusted EBITDA, their margins are 18.2%. Overall, healthcare seems to be growing from revenue to profits to where the company is spending more capex.

With the great client base, the Walmart partnership, and its growing revenue, Tivity is an intriguing contrarian pick in the healthcare space. Because of its cyclical nature with Nutrisystem and the writedown that the company has to do due to the underperformance of Nutrisystem, the risk this stock carries is huge.

For me, I'm looking to sell puts on this company's stock in order to not only generate option premium but also be able to buy the stock at a lower price if ever it goes lower. Hopefully, more corporations will partner with Tivity in providing fitness and nutrition programs for their employees and maybe that will help reduce the cyclicality of the business.

Comments

Post a Comment