Personalis, the next big play in genetics

*This is not financial advice. All content should be considered opinionated. We are not responsible for any of your gains and losses.

Personalis, a growing genomics company that is focused on combating cancer, had its IPO on June of 2019. The company's proprietary tech platform, NeXT, plans to sequence a human's all 20,000 genes. What differentiates NeXT from the cancer diagnostics and liquid biopsy technologies is that NeXT sequences all of the human genes instead of the 50-500 genes found in tissue scans and blood samples.

With the stock down 64% at the time of writing, this stock may present an intriguing opportunity for investors. Here are reasons why Personalis may be a great investment for investors.

1. Personalis has impressive revenue growth and great financials

Personalis has received tons of interest from firms in the medical community as its technology has shown to be very different from other medical diagnostics methods.

Personalis, a growing genomics company that is focused on combating cancer, had its IPO on June of 2019. The company's proprietary tech platform, NeXT, plans to sequence a human's all 20,000 genes. What differentiates NeXT from the cancer diagnostics and liquid biopsy technologies is that NeXT sequences all of the human genes instead of the 50-500 genes found in tissue scans and blood samples.

With the stock down 64% at the time of writing, this stock may present an intriguing opportunity for investors. Here are reasons why Personalis may be a great investment for investors.

1. Personalis has impressive revenue growth and great financials

Personalis has received tons of interest from firms in the medical community as its technology has shown to be very different from other medical diagnostics methods.

According to management, Personali has experienced massive revenue growth. For 2018, revenue grow 302% year over year! That's really impressive! And for Q3 2019, revenue grew 47%, which is still great. Also, management has projected the market to be $5 billion as the technology will not only make medical diagnosing cheaper but will be widely used among the medical community. Finding growth rates like that in the medical diagnostics industry is hard as most of the players are either in liquid biopsy or diagnostics, and both industries are competitive.

Furthermore, the company has a great balance sheet, as displayed below.

With $127.3 million in cash and no debt, this company doesn't seem to be in danger of bankruptcy. Meantime, the company does have $33.7 million in liabilities, but those are customer deposits as many have paid for their genes to be sequenced but haven't received that service yet (*that's what I assume. I haven't dug deep into why they have a huge number of customer deposits).

2. The technology is very different from its competitors, and they have a patent on it

When management says that their tech is proprietary, that means that it's really proprietary. To prove it, here's a link to their patents on the NeXT platform.

In the investor presentation, management compared their NeXT platform with the traditional genomic sequencing technologies. As mentioned in the beginning of this blog post, the traditional technologies sequence 50-500 genes while Personalis sequences 20,000 genes.

To give a picture on the difference between Personalis's technology and the competition, here is another slide that conveys the message that sums it all up.

When comparing NeXT to liquid biopsy or other forms of diagnostics, liquid biopsy and other methods only take samples from one area of the human body while NeXT takes samples from the whole body. Applying this into clinical trials, NeXT will significantly find people that are better candidates for drug trials as many drugs will soon be made to specific people.

3. Personalis has the support of the VA

Having the support of a major government organization that trusts their veterans' data and lives for your company is huge, and that's what Personalis has on their hands. The VA is said to be a long term partner with Personalis, with the VA entrusting Personalis with a huge customer base.

As the VA becomes a big partner with Personalis, Personalis has a stable and huge revenue source. This adds stability to Personalis's revenue. Since Personalis is still undergoing clinical trials for its NeXT platform, all of the business they secured under a contract with the VA will be recognized in the future after they gain approval for using the platform for commercial use.

4. Personalis has big opportunities ahead of itself

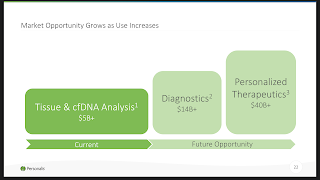

Though their tech focuses on diagnosing cancer, the company plans to expand the use of the NeXT platform. Currently, the platform is being used for analyzing tissue and circulating free DNA (cfDNA), which are basically degraded DNA fragments that are in the blood stream.

As Personalis gains approval for the expanded use of NeXT, it can go on and disrupt diagnostics and then expand further into personalized therapeutics, also known as precision medicine. As you can see, currently the market they're in is worth $5 billion. As time goes on and Personalis gains FDA approval for diagnostics and personalized therapeutics, the company will enter a bigger market and gain more revenue and profits.

And to give a better picture on what's ahead:

With product launches and growing sales that capitalize on its proprietary tech, Personalis may surprise Wall Street with what it has.

To conclude

Personalis is an intriguing biotech company. With technology that can disrupt the genomics industry, Personalis holds a lot of potential. Investors looking for a speculative stock with huge potential should check out Personalis. As time goes on and Personalis gains more FDA approvals, investors will start taking notice.

Meanwhile, the company hasn't made any profits, making this investment speculative. With no debt and a lot of cash in its balance sheet, this reduces the risk of investing in Personalis.

Invest wisely.

Comments

Post a Comment